PUBLIC PROVIDENT FUND (PPF)

PUBLIC PROVIDENT FUND or PPF is a lucrative Investment instrument backed by the Government of India (GOI) offering tax exemptions on both, principal as well as interest.

There is a Minimum deposit ₹ 500/- a maximum deposit ₹ 1,50,000/- in a Financial year. Loan facility is available from 3rd financial year up to 6th financial year.

Introduction of PUBLIC PROVIDENT FUND (PPF):

Investing in the Public Provident Fund (PPF) offers a unique combination of tax benefits and the potential for long-term wealth accumulation through the power of compounding. In this article, we will explore the various aspects of PPF investments, including how they can benefit individuals over a 15-year investment period.

The Power of Compounding in PUBLIC PROVIDENT FUND (PPF) Investments

Compound interest is the key factor that sets PPF investments apart from other financial instruments. The compounding effect allows your investment to grow exponentially over time. Let’s take a closer look at how compounding works in PPF investments:

Understanding Compound Interest

Compound interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. It can be thought of as “interest on interest,” and it can make a substantial difference in the long-term growth of your investment.

Example:

Suppose you invest Rs. 1,00,000 in a PPF or PUBLIC PROVIDENT FUND account at an annual interest rate of 7.1%. Here’s how your investment would grow over a 15-year period:

- Tax Benefits of PPF or Public Provident Fund Investments

One of the most significant advantages of investing in PPF is the tax benefits it offers. Here are some key tax benefits of PPF investments: - Tax Exemption on Investment:

The amount invested in a PPF account is eligible for tax exemption under Section 80C of the Income Tax Act. Individuals can claim a deduction of up to Rs. 1,50,000 in a financial year. - Tax-Free Returns:

The returns generated from PPF investments are tax-free. This means that the interest earned on your investment and the maturity amount are not subjected to tax. - PPF Investment: A Long-Term Wealth Accumulation Tool

PPF investments are ideally suited for long-term wealth accumulation due to their stable returns and tax benefits. Here’s a table illustrating the growth of a PPF investment over a 15-year period:

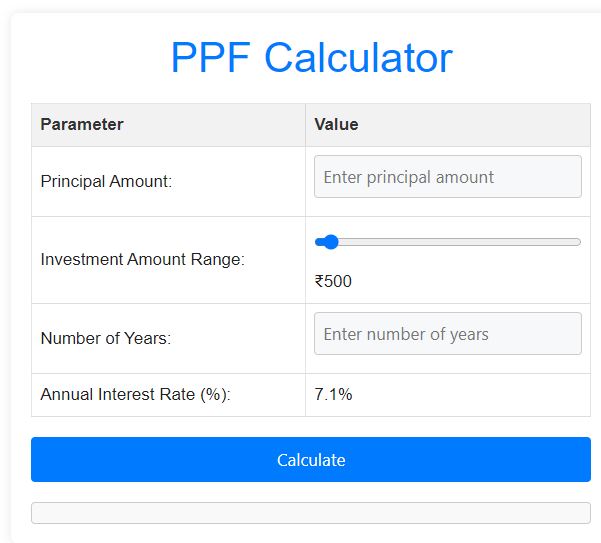

You can check the return of PPF by accessing our PPF calculator by clicking below.

FAQs of PPF.

- Can I partially withdraw money from my PPF account before the completion of 15 years?

Yes, you can make partial withdrawals from your PPF account after the completion of 5 financial years from the end of the year in which the account was opened. - Is the interest earned on my PPF investment taxable?

No, the interest earned on your PPF investment is not taxable, making it an attractive investment option for tax-saving purposes. - Can I avail of a loan against my PPF investment?

Yes, you can avail of a loan against your PPF investment from the 3rd to 6th financial year of opening the account. - What is the maximum amount that can be deposited in a PPF account in a financial year?

The maximum amount that can be deposited in a PPF account in a financial year is Rs. 1,50,000. - Can I extend my PPF account after the completion of 15 years?

Yes, you can extend your PPF account in blocks of 5 years after the completion of 15 years. - What happens if I miss depositing money in my PPF account in a particular year?

If you miss depositing money in your PPF account in a particular year, you will be charged a penalty of Rs. 50 per year of default.

You can also look for EMI Calculator post of us – https://taazatime.info/emi-calculator-by-taazatime/

Conclusion

Investing in PPF offers a unique opportunity to save taxes and accumulate wealth over the long term. By understanding the tax benefits and the power of compounding associated with PPF investments, individuals can make informed decisions to secure their financial future.

Apply for PPF Online from SBI – https://sbi.co.in/web/personal-banking/investments-deposits/govt-schemes/ppf

MORE POSTS :-

IPO-bound Ola Electric slashes prices of e-scooters by up to Rs 25,000

समान नागरिक संहिता विधेयक को मंजूरी देने वाला उत्तराखंड पहला राज्य बन गया